The Rise of Global Investing: Strategies for a Borderless Market

In recent years, the concept of investing has transcended geographical boundaries, leading to what we now recognize as global investing. This paradigm shift has been fueled by advancements in technology, increased accessibility to information, and the growing interconnectedness of economies. Today, investors are not only considering local opportunities but are actively pursuing growth prospects around the world. This article explores the emergence of global investing and outlines effective strategies for navigating this borderless market.

The Evolution of Global Investing

Historically, investing was largely localized, with investors focusing primarily on domestic markets. However, the progress in communication technologies, along with the proliferation of online trading platforms, has democratized access to global financial markets. Investors can now seamlessly trade assets across continents from the comfort of their homes. The rise of globalization, along with the rapid expansion of multinational corporations, has also created opportunities for individuals to invest in diverse markets and asset classes.

As economies become increasingly intertwined, the potential for diversification and risk management has led to a significant shift toward global investing. Markets that were once lauded for their stability are now being evaluated against emerging economies that exhibit robust growth trajectories. Investors are prompted to explore the foreign markets, leading to a rich tapestry of investment narratives.

The Benefits of Global Investing

One of the primary advantages of global investing is diversification. By investing in various geographies, investors can mitigate risks associated with local economic downturns or market volatility. In addition, opportunities found in emerging and frontier markets often present higher growth potential, as these regions can outperform developed markets given favorable conditions.

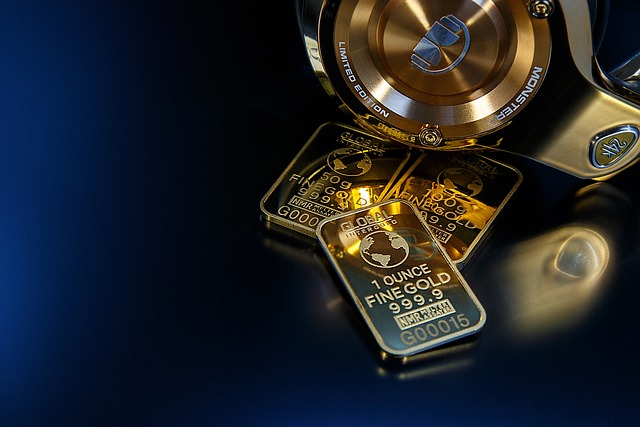

Furthermore, global investing opens the doors to a wider array of asset classes, including stocks, bonds, real estate, commodities, and currencies. This variety enables investors to construct portfolios tailored to their risk appetite and investment goals. Moreover, exposure to foreign currencies can act as a hedge against inflation and currency depreciation in an investor’s home country.

Challenges in Global Investing

While there are numerous benefits, global investing is not without its challenges. Investors face obstacles such as currency risk, geopolitical instability, and regulatory differences. Additionally, understanding the economic landscape, cultural nuances, and market dynamics of foreign countries can be daunting for many investors. It is crucial for investors to conduct thorough due diligence and research before entering foreign markets.

The complexity of navigating international regulations can also pose difficulties. Tax laws, disclosure requirements, and investment limitations differ significantly across jurisdictions, affecting the overall investment process. As a result, investors must be prepared to engage with legal and financial experts to ensure compliance and optimize their investment strategies.

Strategies for Successful Global Investing

To navigate the complexities of global investing, it’s vital to adopt informed strategies. Below are core strategies that aspiring global investors should consider:

Research and Education

Thorough research is the backbone of successful global investing. Investors should familiarize themselves with various markets, economic indicators, and political climates. Staying updated on global news, international trade agreements, and changes in monetary policy will help investors make informed decisions. Many resources are available, from economic reports and market analyses to webinars and online courses, to bolster financial literacy in foreign markets.

Build a Diverse Portfolio

Diversification is essential in mitigating risks associated with global investing. A well-diversified portfolio includes exposure to different asset classes across multiple geographies. By investing in stocks from various industries and bonds from different countries, investors can buffer their portfolios against the volatility seen in a specific market or sector. Additionally, considering alternative investments such as real estate or commodities can further enhance diversification.

Utilize Technology and Investment Platforms

Modern technology has made it easier than ever for investors to access global markets. Online brokerage platforms enable investors to trade and research assets from around the world with relative ease. Robo-advisors and investment apps simplify portfolio management, allowing investors to manage their assets and receive personalized advice based on their risk tolerance and investment goals.

Monitor Currency Risks

Currency fluctuations can have a substantial impact on investment returns, especially for those investing in foreign assets. To manage currency risk, investors may consider using hedging strategies, such as currency futures or options. Additionally, understanding the factors that influence exchange rates—such as interest rates, inflation, and political stability—can aid investors in making informed decisions regarding their international investments.

Engage with Local Experts

Leverage the expertise of local investment professionals when entering foreign markets. Local experts possess critical insights and knowledge regarding market practices, cultural norms, and regulatory compliance. Collaborating with local financial advisors, legal representatives, and industry specialists can significantly enhance investment effectiveness while minimizing potential pitfalls.

Future Trends in Global Investing

As we look toward the future, several trends will shape the landscape of global investing. The rise of sustainable and socially responsible investing (SRI) is gaining momentum, with investors increasingly considering the environmental, social, and governance (ESG) aspects of their investments. This paradigm shift is not only a response to growing concerns over climate change and social equity but also reflects a recognition that sustainable businesses often yield better long-term performance.

Additionally, advancements in technology, such as artificial intelligence and big data analytics, are transforming how investors analyze markets and make decisions. Investors can utilize sophisticated tools to gain insights and improve portfolio performance. Furthermore, the rise of blockchain technology and cryptocurrency investment is creating new avenues for diversifying financial strategies, adding liquidity to once-illiquid markets.

Conclusion

The rise of global investing represents a paradigm shift in how individuals and institutions approach asset allocation and portfolio management. With countless opportunities and challenges in the borderless market, investors must equip themselves with the right knowledge and strategies to thrive. By embracing diversification, leveraging technology, and staying informed about global trends, investors can unlock the potential of global investing and strategically navigate the paths to success.

As the world continues to evolve and economies grow increasingly interconnected, it will be imperative for investors to adapt and evolve as well. The future of investing is undeniably global, and those ready to embrace this change will stand to reap rewards from the boundless possibilities that lie ahead.