The Future of Global Investing: Trends Shaping Tomorrow’s Markets

In a rapidly changing world, the landscape of global investing is continuously evolving. Investors are increasingly required to navigate through a myriad of factors that influence markets across different regions and sectors. This article delves into the significant trends shaping tomorrow’s markets, from technological advancements and regulatory changes to environmental sustainability and shifting global demographics. Understanding these trends is vital for both institutional and individual investors seeking to position themselves advantageously for the future.

The Impact of Technological Innovation

Technology is one of the most transformative forces in global investing today. Innovations in financial technology (fintech) have made investing more accessible and efficient than ever before. Robo-advisors, for instance, are now commonplace, providing automated, algorithm-driven financial planning services. These platforms make investing more democratic, allowing individuals with limited knowledge or capital to participate in the markets.

Blockchain technology also poses a revolutionary change in how investments are tracked and verified. By providing a decentralized ledger that is transparent and immutable, blockchain can significantly reduce fraud, streamline transactions, and enable the trading of a broader range of assets, including cryptocurrencies and tokenized real estate. As confidence in these technologies grows, we can expect to see increased adoption across various investment avenues.

ESG Investing and Sustainability

Environmental, social, and governance (ESG) investing is no longer just a trend; it has become a vital component of investment strategies worldwide. Investors are increasingly focusing on sustainable practices, pushing companies to prioritize ecological and social accountability. The rise of responsible investing is driven by a growing awareness of climate change, social inequality, and corporate governance issues.

In response to this demand, many financial institutions are developing ESG funds that allow investors to align their portfolios with their values. Regulations are also evolving, with many countries increasing scrutiny and requiring greater transparency regarding companies’ ESG practices. This shift is not just about ethical considerations; it is increasingly recognized that sustainable practices often correlate with long-term financial performance, making ESG integration a strategic imperative for investors.

Global Demographic Shifts

Demographics play a crucial role in shaping market trends. As populations age in many developed countries, the investment focus is gradually shifting. Younger generations, particularly millennials and Gen Z, are entering the workforce and becoming significant players in the investment landscape. Their preferences often lean towards technology-driven solutions, sustainable businesses, and socially responsible investments.

Simultaneously, emerging markets are experiencing rapid growth and urbanization, leading to the creation of a robust middle class. Countries in Asia, Africa, and South America are expected to drive global economic growth. Investors seeking diversification and higher returns are increasingly looking to these markets, which present both opportunities and risks. The challenge lies in understanding local regulations, cultures, and market dynamics, but the potential rewards make these markets attractive to discerning investors.

Geopolitical Factors and Market Volatility

The geopolitical landscape is continually shifting, and its implications for global investing are profound. Trade wars, political instability, and emerging conflicts can create significant volatility in markets. Investors must remain vigilant, adapting their strategies to navigate through potential disruptions. The COVID-19 pandemic has exemplified how interconnected markets can be affected by global events, and the lessons learned during this period will likely shape future investment strategies.

In this context, geopolitical intelligence becomes essential. Investors are now paying more attention to country risk assessments and geopolitical forecasts when considering where to allocate their assets. Understanding the intricate tapestry of international relations can guide investment decisions and help identify safe havens during turbulent times.

The Rise of Alternative Investments

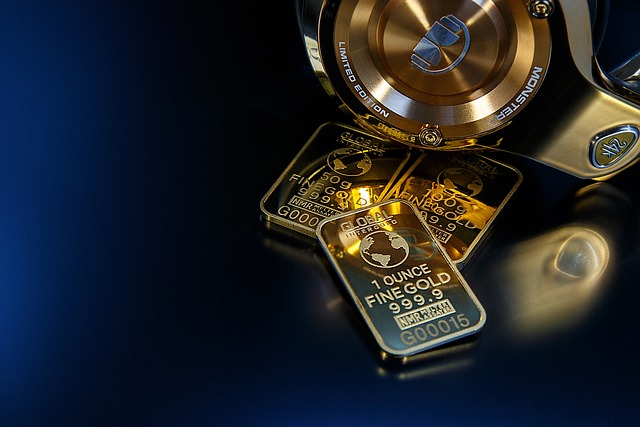

As traditional asset classes, such as stocks and bonds, face uncertainty, alternative investments are gaining traction. These include assets like private equity, hedge funds, real estate, and commodities. Such investments can provide diversification and cushion portfolios against market volatility.

Private equity, in particular, is becoming an attractive option for investors seeking higher returns. With interest rates remaining low in many developed economies, institutional investors are reallocating capital into private markets. These investments may be illiquid but can offer substantial rewards for those willing to engage with them over the longer term.

Digital Assets and Cryptocurrencies

The emergence of digital assets and cryptocurrencies has created new opportunities—and challenges—within the investment landscape. Bitcoin, Ethereum, and numerous altcoins have gained significant popularity, attracting both speculative and strategic investors. The decentralized nature of cryptocurrencies allows for borderless transactions and can potentially disrupt traditional financial institutions.

However, investing in cryptocurrencies is not without risk. The volatility of these assets can lead to substantial losses, and regulatory frameworks are still in development around the world. Despite these challenges, institutional acceptance of cryptocurrencies is growing, with major banks and investment firms launching products and services that incorporate digital currencies.

Globalization vs. Localization

As markets become increasingly interconnected, investors are faced with the challenge of globalization versus localization. While global investing offers diverse opportunities, local markets can sometimes provide more stability and better understanding. Some investors believe that focusing on local companies leads to better returns since they are often more insulated from international volatility.

Moreover, as supply chains draw closer to home—with a trend commonly referred to as “reshoring”—investors may see opportunities in domestic companies that are well-positioned to capitalize on these changes. Thus, striking a balance between global diversification and local investment may be the key to successful investment in the future.

The Role of Artificial Intelligence and Big Data

Artificial intelligence (AI) and big data are transforming the investment landscape. The ability to analyze vast quantities of information quickly enables investors to make informed decisions based on real-time market data. Predictive analytics, assisted trading, and automated portfolio management are becoming standard features of modern investing.

Utilizing AI to predict market trends and consumer behavior can provide an edge in investment strategies. Additionally, big data helps investors identify patterns that were previously overlooked, allowing for a more comprehensive understanding of market dynamics. While these tools enhance investment strategies, they also require investors to adapt to new technologies and methodologies.

Conclusion: Preparing for Tomorrow’s Markets

The future of global investing is being shaped by an array of trends that intersect technology, sustainability, demographics, and geopolitical dynamics. As investors prepare for this evolving landscape, it is essential to remain informed and adaptable. Continuous education, diversification, and a keen eye for emerging opportunities will be crucial for navigating the complexities of tomorrow’s markets.

Ultimately, the ability to anticipate and respond to change will mark the distinction between successful investors and those left behind. By embracing technological advancements, prioritizing sustainability, understanding global dynamics, and leveraging new investment opportunities, savvy investors can position themselves to thrive in the future of global investing.